While Japan is embracing cashless payments, cash (“genkin” / 現金) is still essential for many smaller shops, restaurants, and temples.

For many foreigners, getting cash can be a stressful experience, as most domestic bank ATMs do not accept foreign-issued cards.

But don’t worry!.

This guide will show you exactly how to find foreigner-friendly ATMs and use them with confidence.

Where to Find Foreigner-Friendly ATMs

Forget the ATMs at major Japanese banks like Mizuho or MUFG.

Instead, head straight for one of these two reliable options:

- Seven Bank ATMs (セブン銀行ATM): Your best and most reliable option. Found inside every 7-Eleven convenience store, which are located virtually everywhere in Japan. They are available 24/7 and have an English language menu.

- Japan Post Bank ATMs (ゆうちょ銀行ATM): Found inside post offices. They also accept a wide range of foreign cards and have an English menu. Their operating hours are usually limited to the post office’s business hours.

Step-by-Step: How to Use the ATM

Using these ATMs is simple.

Here’s the typical process:

- Select your language: Press the “English” button on the welcome screen.

- Insert your card: Put your card into the machine.

- Select “Withdrawal”: Choose the withdrawal option.

- Enter your PIN: Use the keypad to enter your card’s PIN.

- Choose your account: Select “Savings” account.

- Select the amount: Choose one of the preset amounts or enter a custom amount.

- Confirm the transaction: The screen will show you the amount, and may display a warning about service fees. Confirm to proceed.

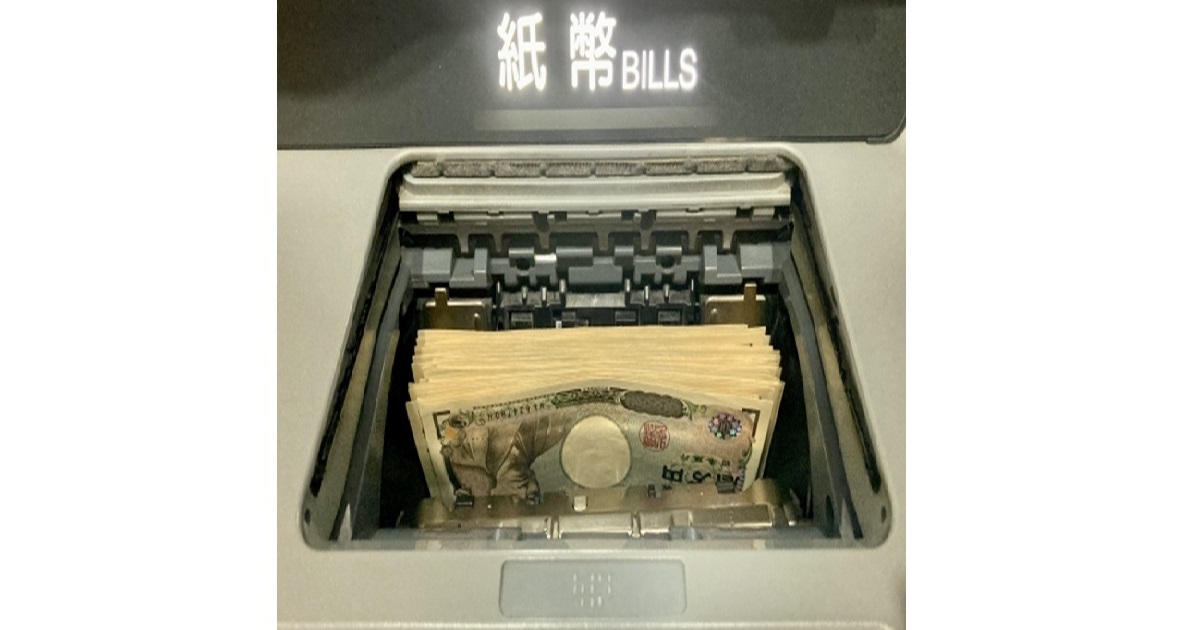

- Take your cash, card, and receipt: Don’t forget to take everything!.

Important Notes on Fees and Limits

Be aware of these potential costs:

- ATM Fee: The Japanese ATM provider (e.g., Seven Bank) will usually charge a small fee (e.g., ¥110 or ¥220) for the service.

- Your Home Bank’s Fee: This is often the bigger cost. Your own bank will likely charge you a fee for using a foreign ATM and may also give you an unfavorable exchange rate. Check your bank’s policy before your trip.

- Withdrawal Limits: Most ATMs have a per-transaction limit, often around ¥100,000 for foreign cards.

Stay Connected for Financial Peace of Mind

When dealing with money abroad, having a reliable internet connection is crucial.

You might need to check your bank balance on your phone, use a currency converter app, or contact your bank in an emergency.

Renting a Pocket WiFi or getting a travel eSIM ensures you’re always connected.

You Might Also Like

One of the best ways to reduce your reliance on cash is by using a rechargeable IC card for all your transportation needs.

Learn how to get and use one here.

Japan’s IC Cards: Your Guide to Suica, Pasmo, and More

If you found this guide helpful, please give it a like!.